Recent Videos

6 Stock Market Predictions For 2026

As we turn the calendar to 2026, I reveal my forecasts for the stock market, interest rates, and top asset classes, and take a look back at how my 2025 predictions stacked up against reality.

From the S&P 500’s rollercoaster performance to the ongoing rivalry between growth and value stocks, and even a showdown between bitcoin and gold, I break down what the numbers were, where I hit the mark, and where I missed. You’ll also hear my insights on international versus U.S. stocks, the outlook for small caps, and what the Federal Reserve might do with interest rates in the year ahead.

Get ready for smart strategies, listener thank-yous, and a dose of investing reality as I help you set expectations (and goals) for the year to come.

Most Asked Financial Questions of 2025

2025 has been a year of significant highs and lows, a bittersweet time marked by personal loss but also tremendous growth in our community of listeners and clients. As we wrap up the year, I wanted to take a moment to reflect and, more importantly, to give back by answering the most pressing questions on your minds.

In this episode, I’m tackling the top 10 most asked financial questions I received in 2025 from both clients and listeners. From the future solvency of Social Security and the reality of rising inflation to the specifics of Bitcoin and long-term care, we are covering the topics that directly impact your retirement confidence.

I also share a special thank you gift to you my listeners: a significant discount on my Retirement Readiness Review course to help you kickstart your 2026 planning. Whether you are wondering if you should pay off your mortgage or how to find a truly objective financial advisor, this episode provides the clear, direct answers you need to navigate your financial future.

Top 5 Tax Benefits of 529 Plans

529 college savings plans are a favorite tool for families looking to fund education, but recent updates have made them even more compelling. With the passing of the One Big Beautiful Tax Act in 2025, there have been some exciting changes to what you can use 529 funds for, including expanded coverage for K-12 tuition, test fees, vocational programs, and support for learning differences.

I also discuss the various tax advantages of contributing to a 529 plan, like state tax deductions, tax-deferred growth, and even the ability to roll leftover funds into a Roth IRA for your child. He offers real-life examples, highlights differences across state plans, and gives practical tips on maximizing your savings and tax benefits as the year wraps up.

If you’re looking to make the most out of your child or grandchild’s future education while being smart about your finances, this episode is packed with must-know information.

4 Ways To Receive A Tax Deduction For Charitable Contributions in 2025 and 2026

In the season of giving, we’re discussing making charitable contributions in 2025 and 2026. Americans are known for their generous donations to worthy causes, but understanding the best ways to give and maximize your tax benefits is key.

This episode covers four effective strategies for making charitable contributions, from utilizing Qualified Charitable Distributions (QCDs) from your retirement accounts to cash donations, gifting highly appreciated stock or real estate, and using donor-advised funds. I also break down recent and upcoming tax law changes that impact your ability to itemize and deduct charitable donations, ensuring you avoid common pitfalls and make the most of your generosity.

Whether you’re planning a gift this year or thinking ahead, this episode is packed with actionable tips to help you give back and plan for a successful retirement.

2026 Medicare Part B Premium Surprises

Healthcare planning is a huge part of getting ready for your retirement. In this episode, I tackle one of the most pressing updates for retirees: the latest changes to Medicare premiums for 2026, including important surcharges, deductibles, and strategies to help you manage your healthcare expenses.

I’m helping you understand the significant increases in Medicare Part B premiums and deductibles, the impact these changes will have on your Social Security benefits, and why waiting to claim Social Security might pay off.

Listen in to get helpful strategies for appealing IRMAA surcharges and practical tips for structuring your income to minimize additional Medicare costs. If you’re planning for retirement or already navigating Medicare, this episode is packed with timely advice to help you make informed decisions about your healthcare and finances.

7 Year End Tax Moves For Pre-Retirees in 2025

As 2025 comes to a close, we’re here to help you make the most of year-end tax planning. I’m explaining seven actionable strategies to help you minimize your tax liability and optimize your retirement savings before the New Year.

From maximizing retirement plan contributions and exploring Roth conversion opportunities to using donor-advised funds for charitable giving and getting the most from your health savings accounts, this episode is packed with practical advice. The insights I’m sharing in this episode will guide you through the essential moves you need to consider before December 31st.

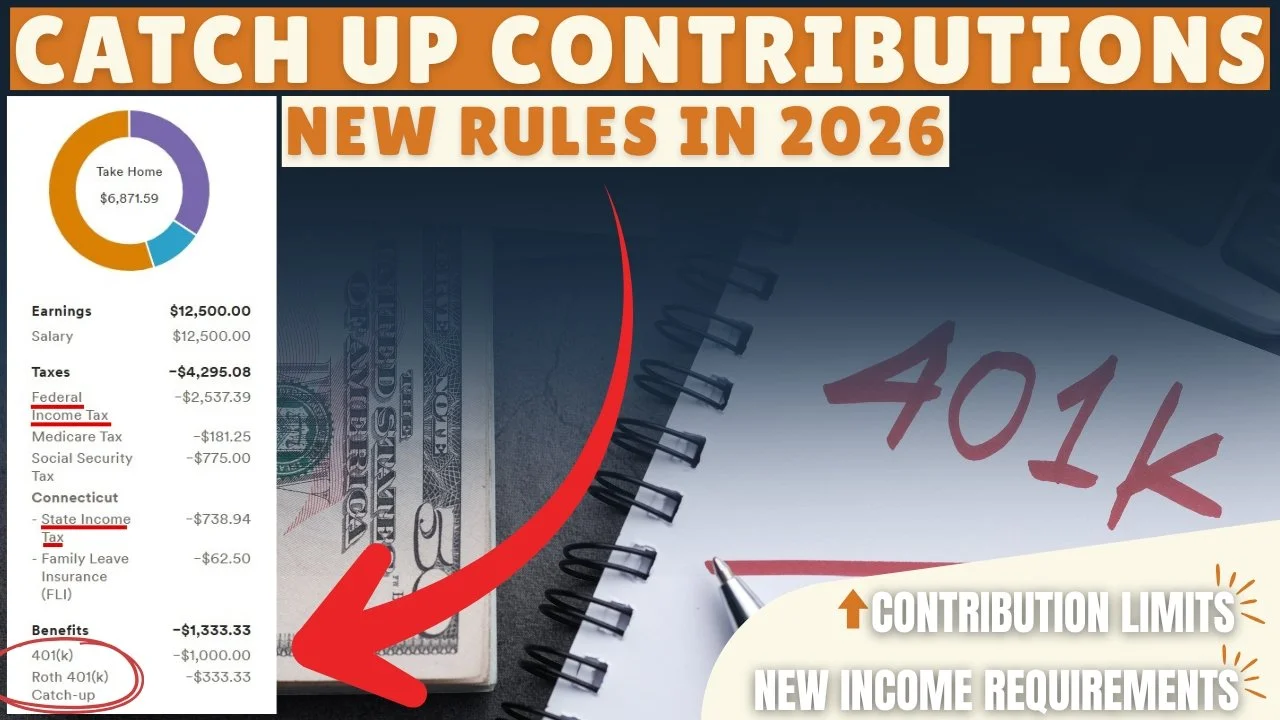

Major Changes Coming To 401K, 403B, and 457 Retirement Plans in 2026

There are important changes coming to 401 (k), 403 (b), and 457 retirement plans in 2026, so I’m focusing on how these updates may impact catch-up contributions for individuals over age 50. With the Secure Act 2.0 on the horizon, higher earners will soon have to make their catch-up contributions as Roth (post-tax) rather than pre-tax contributions, potentially affecting their take-home pay and tax strategies.

Tune in as I walk you through what you need to know, how to prepare for these new rules, and actionable steps to make the most of your retirement savings.

Mapping Out A Plan For Roth Conversions

If you’ve spent any time on social media or read personal finance blogs, you’ve likely encountered a buzz around Roth IRAs and, specifically, Roth conversions. This week I’m discussing the details of Roth conversions, what they are, how they work, and why they’re crucial for those looking to optimize their retirement finances.

Roth IRAs hold a special appeal: the promise of tax-free income in retirement. And most people would agree that having tax free income in retirement is preferable over having taxable income. Yet, for many people, especially those in their 50s and older, most of their retirement savings sit in pre-tax accounts such as traditional IRAs or 401(k)s. Roth conversions offer a pathway for transforming those tax-deferred assets into tax-free retirement income.

This episode is packed with practical insights to help you make informed decisions about your financial future. Tune in to learn more and get ready to take your retirement planning to the next level!

Social Security 2026 Cost Of Living Update

Retirement planning is an ever-evolving process, and staying informed about changes to Social Security, Medicare, and tax limits is crucial to making the most of your golden years. On this episode of Retire with Ryan, I’m sharing important updates on the 2026 Social Security cost of living adjustment (COLA), projected changes to Medicare Part B premiums, and strategies for managing income in retirement.

The newly announced cost-of-living adjustment (COLA) for 2026 will see benefit checks rise by 2.8%. I break down how the yearly adjustments are calculated, why they matter for seniors, and the impact of inflation on Social Security. I also discuss the expected jump in Medicare Part B premiums, what IRMAA means for higher-income retirees, and important changes to the Social Security wage base and retirement earnings limits.

Whether you're thinking about when to start your benefits or you want to strategize your retirement income, this episode will give you practical tips and resources to help you make the most of your retirement planning.

What is a Fiduciary Advisor and Why It Matters

With the term “financial advisor” being used so broadly these days, it’s harder than ever for retirees and investors to make sense of who’s actually guaranteed to act in their best interest. So let’s talk about the key responsibilities of fiduciaries, explore the differences between fee-only advisors and those who earn commissions, and go through why full disclosure and ongoing advice matter so much in your financial planning relationship.

I share practical tips on how to vet potential advisors, whether you’re unhappy with your current one or searching for the right fit for the first time, and discuss online resources designed to help you find an aligned, trustworthy professional. If you want to make sure your advisor is truly putting your interests first, this episode is for you.

Switching Plans and Saving Money During Medicare’s Annual Open Enrollment

Every year, Medicare Open Enrollment presents an important opportunity for retirees and individuals enrolled in Medicare to review, update, and make changes to their health and prescription drug coverage. If you’re on Medicare or approaching retirement, understanding the enrollment period and your options is crucial to ensuring comprehensive and cost-effective health care.

I’m sharing the seven essential things you need to know to make the most of this important window. Whether you’re already enrolled in Medicare or want to stay ahead of your retirement planning, I explain key dates, your options for switching plans, how to review or update your prescription drug coverage, and what to do if your health or coverage needs have changed.

Tune in to learn about navigating Medicare Advantage, Medigap, and everything you should consider before December 7th to keep your health and finances on track as you plan your ideal retirement.

Key SECURE Act Insights on Avoiding 25 Percent Penalties on Inherited IRAs

This episode is essential listening for anyone who’s inherited an IRA, especially in light of the game-changing SECURE Act. If you’ve inherited a retirement account from a non-spouse since 2020, this episode is packed with details you need to know to avoid unexpected tax bills and penalties.

I explain the new rules for inherited IRAs, explaining the requirements and options for non-designated, non-eligible, and eligible designated beneficiaries. Whether you’re figuring out minimum distributions or seeking smart tax-planning strategies, you’ll get clear guidance on how these updates affect you, plus tips to steer clear of common mistakes in 2025 and beyond.

Seven Essential Tips to Maximize Your Lifetime Social Security Benefits

You might have seen those viral articles promising a mysterious multi-thousand-dollar Social Security “bonus,” but are they actually legit? On the show this week, I separate fact from fiction, debunking the myths and sharing seven actionable strategies to help you get the most out of your Social Security over your lifetime.

Whether you’re curious about how working longer, delaying your benefits, checking your earnings record, or understanding tax implications can impact your retirement paycheck, this episode is packed with valuable tips to help you make sure you’re not leaving money on the table.

What Retirees Need to Know About The Social Security Fairness Act

The Social Security Fairness Act, which was signed into law at the start of 2025, has been in effect for about nine months since this game-changing legislation repealed both the Windfall Elimination Provision and the Government Pension Offset, restoring and increasing Social Security benefits for millions of retirees, especially teachers and public employees who worked in jobs exempt from Social Security.

In this episode, I discuss exactly who qualifies for these newly restored benefits, explain how the Social Security Administration is handling the rollout, and give you a step-by-step guide on what to do if you haven’t received your payment yet. I’ll also walk you through critical tax changes you’ll need to consider if you’re now receiving this extra income, and practical strategies to avoid any nasty tax surprises at the end of the year.

Is a Million Dollars Enough to Retire?

It’s one of the most frequently asked questions by my clients as they prepare for retirement. And while a million dollars may sound like a lot, the reality is a bit more complex.

There are several key factors to consider when planning your retirement, including factoring in taxes, evaluating withdrawal strategies, and understanding the cost of living where you plan to retire.

Let’s break down how you can determine whether your nest egg will support your ideal retirement.

Avoid These Seven Medicare Enrollment Mistakes and Protect Your Finances

Are you turning 65 soon or starting to think seriously about healthcare in retirement? This week, I discuss the complicated world of Medicare—with a focus on the seven most costly mistakes people make when enrolling.

From missing crucial deadlines and underestimating penalties, to overlooking the true costs Medicare doesn’t cover and getting tripped up by income-related surcharges, I give practical advice to help you avoid expensive pitfalls and make confident choices for your health and your wallet.

Whether you’re working past 65, exploring Medicare Advantage and Medigap, or just want to sidestep penalties, this episode unpacks the essentials so you can enter retirement feeling prepared and protected. Let’s get into the key rules, deadlines, and decisions every retiring listener needs to know!

Education Planning After the One Big Beautiful Bill Act: Key 529 Plan Changes

Paying for education is a major expense for many families, so I’m breaking down why 529 plans remain the preferred way to save for college, thanks to their tax advantages and flexible growth. I unpack updates, such as increased limits for K-12 tuition withdrawals, expanded uses for trade and vocational schools, and the new ability to roll funds into ABLE accounts for individuals with disabilities.

Plus, learn about the new Trump accounts, the option to roll over leftover 529 funds into your child’s Roth IRA, and strategies to make the most of your education savings. Whether you’re a parent, grandparent, or simply curious about planning for future expenses, this episode is packed with actionable insights to help you build a successful financial future for your family.

Maximizing Spousal Social Security Benefits for Married Couples

For married couples planning their retirement, understanding spousal Social Security benefits can seem like a labyrinth. This week, I’m answering a listener's question about how spouses can maximize their Social Security benefits. Join me as I break down the key rules, eligibility requirements, and strategies that can help you and your spouse make the most of your benefits over your lifetimes.

Whether you're nearing retirement or still a few years away, I can help you understand primary insurance amounts, full retirement age, and what happens if one spouse claims benefits early. If you want to ensure you and your loved one have a smart plan for Social Security, this episode offers essential insights and actionable advice.

Understanding HSA Changes for 2026

The power of Health Savings Accounts (HSAs) as a tool for both managing health expenses and building your retirement savings is often overlooked. On this episode, I’m sharing the basics of HSAs, highlighting their triple tax-free advantage, and explaining why they might be one of the best ways to maximize your retirement savings, even compared to more familiar accounts like IRAs and 401(k)s.

I also unpack some important upcoming changes to HSAs thanks to the One Big Beautiful Bill Act, set to take effect in 2026. These changes expand HSA eligibility, especially for those on healthcare exchange plans and direct primary care memberships. Whether you’re new to HSAs or looking to fine-tune your retirement strategy, my practical tips—like how to track reimbursements, invest your HSA funds wisely, and ensure you’re making the most of every retirement planning opportunity.

Surviving the ACA Subsidy Cliff

The future of Affordable Care Act (Obamacare) subsidies is a pressing issue for retirees and anyone shopping for health insurance on the ACA marketplace. With the generous subsidies brought by the American Rescue Plan Act set to expire at the end of 2025, I break down exactly how these subsidies work, what changes are coming in 2026, and what that means for your wallet.

We’re talking eligibility thresholds, how income is calculated, why premiums might rise, and—most importantly—shares practical strategies for lowering your adjusted gross income to continue qualifying for subsidies as the rules tighten. Whether you're planning to retire before age 65 or just want to make sure you're making the most of affordable health options, this episode is packed with actionable advice to help you navigate the shifting health insurance landscape. Stay tuned to hear how you can prepare before the subsidy cliff arrives.