7-year-end tax moves for pre-retirees

As the end of the year approaches, are you wondering what you can do to minimize your tax burden as a pre-retiree? In this blog post, we’ll explore seven powerful year-end tax strategies specifically designed for pre-retirees. These strategies can help you reduce your taxable income, maximize retirement contributions, and take full advantage of tax-advantaged accounts. Whether you’re looking to boost your savings or lower your tax bill, these tips will guide you in making smart financial choices as you near retirement. Let’s dive into these 7 tips and set you up for a more financially secure future.

7 Tips Overview:

Maximize Contributions to Retirement Plan

Utilize After-Tax Contributions for a Mega Backdoor Roth

Review Roth Conversion Opportunities

Make Charitable Contributions via a Donor-Advised Fund

Exercise Non-Qualified Stock Options

Max Out Flexible Spending Account (FSA) Contributions

Maximize Health Savings Account (HSA) Contributions

Tip #1: Maximize Contributions to Retirement Plan

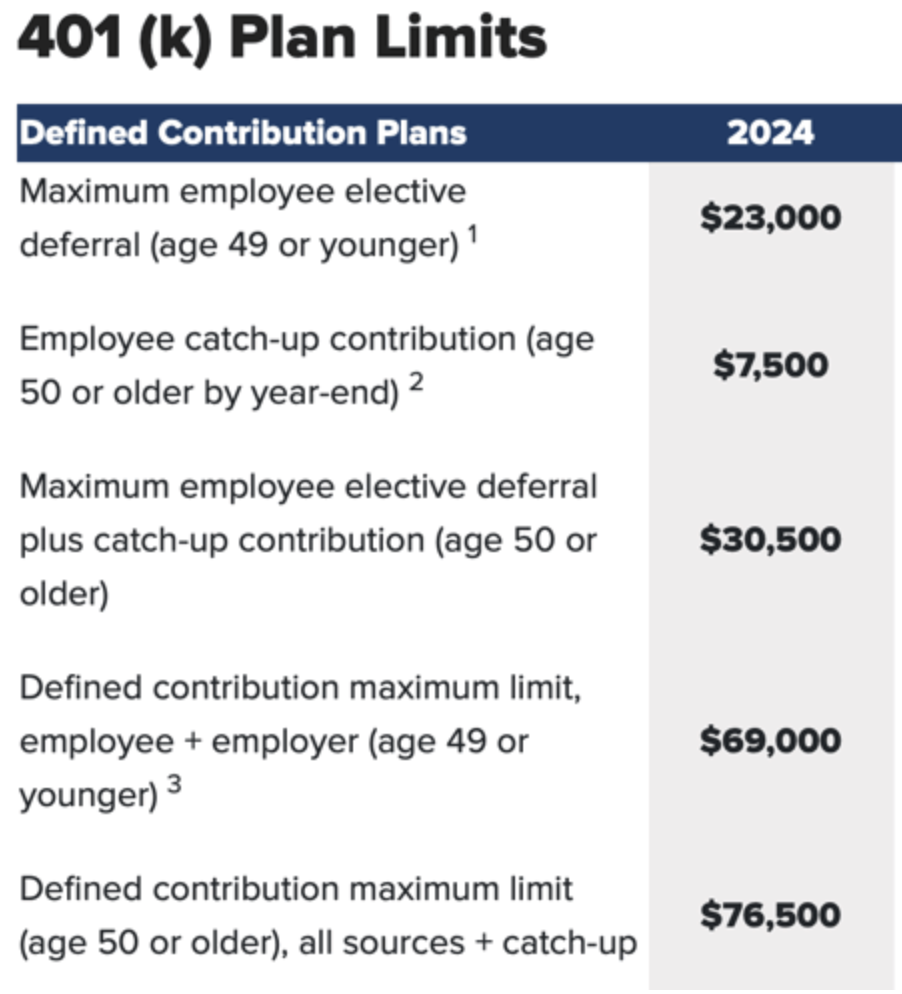

The first tip is to make sure you are maximizing your contributions into your retirement plans such as 401k, 403b, and 457 plans. Or if you are not able to maximize, increase your contributions. Retirement accounts like 401k’s offer pre-tax contributions, which lower your taxable income for the year. This is especially beneficial during peak earning years (late in your career) when your tax bracket is likely higher than it will be in retirement. For example:

If you’re earning $100,000 a year and contribute the maximum of $30,500 to your 401(k), your taxable income drops to $69,500.

This could save you thousands of dollars in taxes, depending on your tax bracket.

Further, check if your employer offers matching contributions. If so, aim to contribute at least enough to get the full match, as this is essentially free money for your retirement. For instance, if your employer matches 50% of your contributions up to 6% of your salary, contributing at least 6% ensures you maximize this benefit.

Tip #2: Utilize After-Tax Contributions for a Mega Backdoor Roth

The second tip is to utilize after-tax contributions for a Mega Backdoor Roth. This tip applies to those who’s employer plan allows them to make after-tax contributions above the standard limits and convert them to a Roth account. For high earners, this strategy is a powerful way to save more for retirement and enjoy tax-free growth. Here’s how it works:

The total 401k contribution limit for 2024 (including employer contributions) is $69,000 if you’re under 50 and $76,500 if you’re 50 or older.

After maxing out pre-tax contributions, you can make additional after-tax contributions up to these limits, provided your employer’s plan allows it.

Once these funds are contributed, they can be converted to a Roth IRA or Roth 401k, where they grow tax-free, and withdrawals are tax-free in retirement.

Tip #3:

Going off of tip #2, tip #3 is to review Roth conversion opportunities. Convert funds from traditional pre-tax accounts (such as IRAs or 401k’s) to Roth accounts to take advantage of potentially lower tax brackets in retirement. A Roth conversion involves paying taxes now on pre-tax funds in exchange for tax-free growth and withdrawals later. This strategy is especially beneficial during years when your taxable income is temporarily lower, such as just before or early in retirement. Benefits include:

Tax Diversification: Having both pre-tax and Roth accounts provides flexibility in retirement, allowing you to manage withdrawals to minimize taxes.

Tax-Free Growth: Once converted, funds grow tax-free in the Roth account, and withdrawals are tax-free in retirement.

Tip #4:

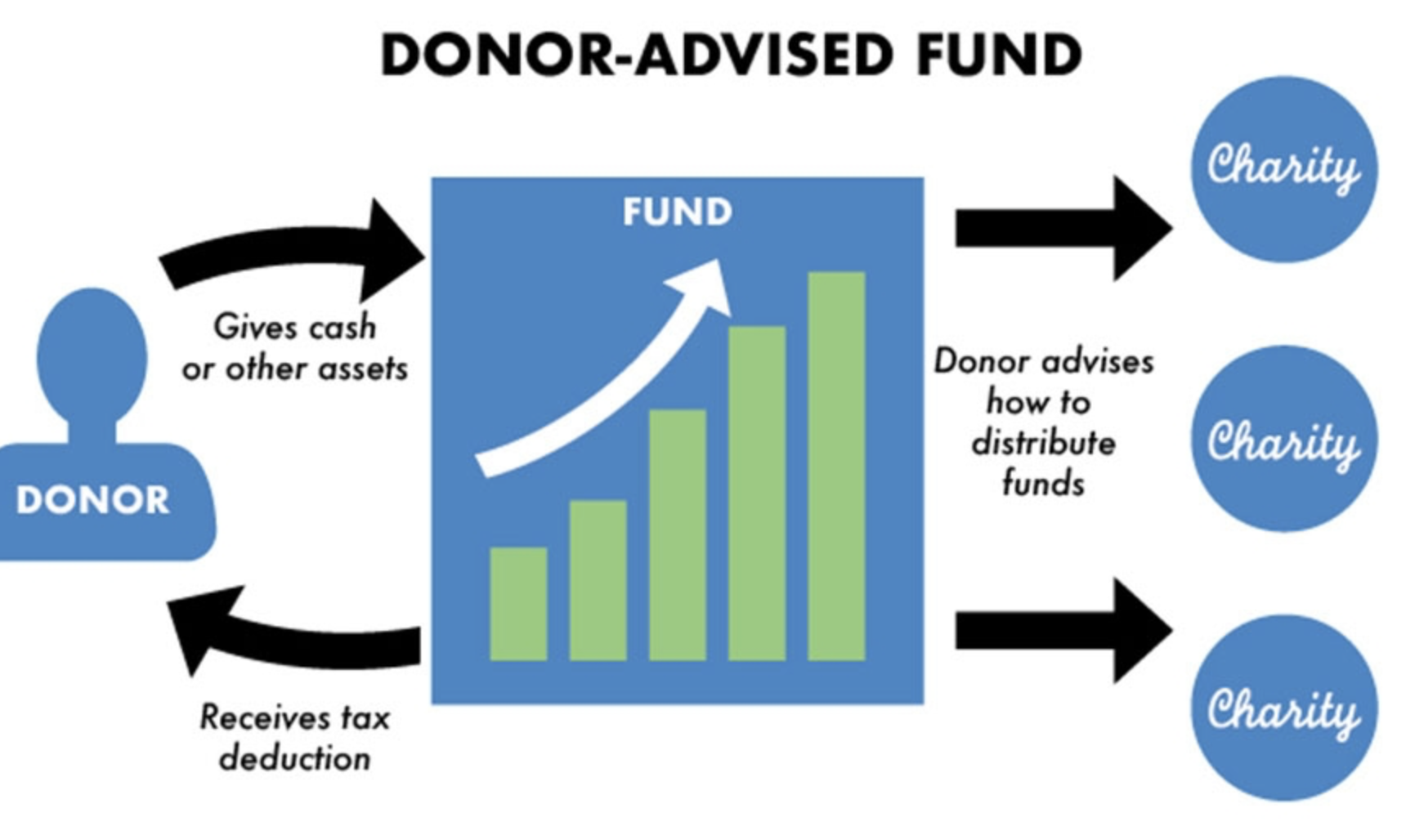

The fourth tip is to make charitable contributions via a donor-advised fund. Charitable contributions are only deductible if you itemize your taxes. However, many pre-retirees no longer itemize due to the higher standard deduction. A donor-advised fund (DAF) helps overcome this limitation by allowing you to "bunch" multiple years’ worth of donations into one tax year, enabling you to exceed the standard deduction threshold. For example:

Suppose you donate $3,000 annually to charity. If you group five years’ worth of donations ($15,000) into a DAF, you may be able to itemize and claim a deduction for that tax year.

The funds remain in the DAF, and you can distribute them to your chosen charities over several years.

Tip #5:

The fifth tip is to exercise non-qualified stock options. Non-qualified stock options (NSOs) are a type of stock option that companies offer to employees or others to buy company stock at a set price, usually below its market value. NSOs are taxed as ordinary income when exercised, so timing is critical to minimize your tax liability. Pre-retirees, especially those anticipating lower income in retirement, can benefit by exercising options during a year when their income is lower than usual. For example:

If you earn $150,000 this year and expect to earn $80,000 in retirement, it may make sense to delay exercising your options until after you retire.

Alternatively, if this year’s income is lower than usual—for instance, due to a sabbatical or job change—it might be the perfect time to exercise.

Review your NSO agreement and consult with a tax advisor to identify the best timing based on your projected income and tax bracket.

Tip #6:

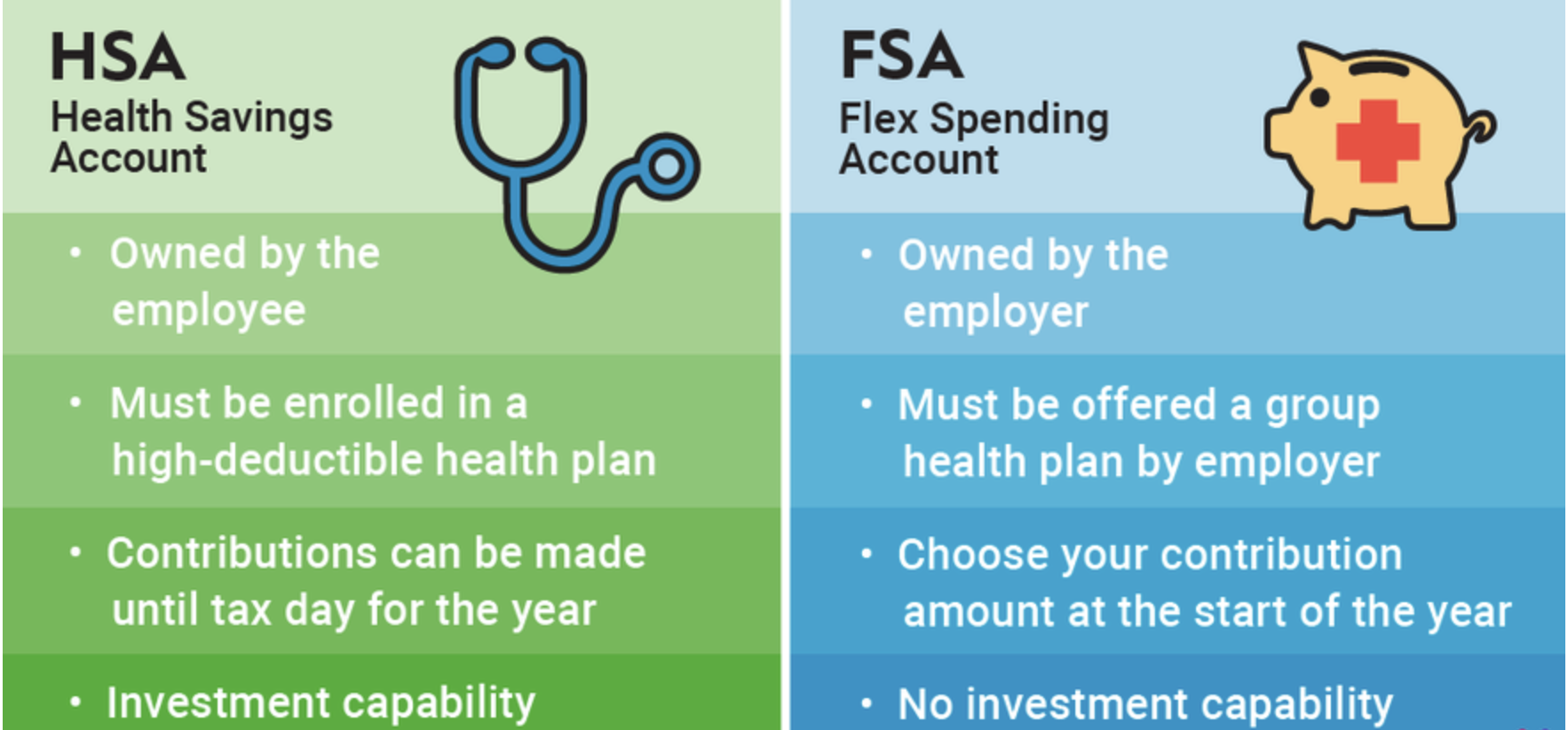

Tip #6 is to contribute the maximum allowable amount to your Flexible Spending Account (FSA) to save on out-of-pocket medical, dental, vision, or dependent care expenses. FSAs allow you to set aside pre-tax dollars to cover eligible expenses, reducing your taxable income. These accounts are particularly helpful if you know you'll incur predictable healthcare or dependent care costs. For example, if you are in the 30% tax bracket, if you expect to spend $3,200 on medical expenses in 2024 and contribute that amount to an FSA, you could save around $960 in taxes (30% of $3,200).

Healthcare FSA: For 2024, you can contribute up to $3,200. This account can be used for medical expenses like co-pays, prescriptions, and medical equipment.

Limited Purpose FSA: If you have a high-deductible health plan (HDHP), you may be eligible for a limited-purpose FSA, which can cover dental and vision expenses.

Dependent Care FSA: This account is for childcare expenses, such as daycare or after-school care, and allows contributions up to $5,000 for families or $2,500 per individual.

FSA contributions are typically set during your employer’s open enrollment period. However, certain qualifying life events—such as a birth, marriage, or change in employment—may allow you to adjust contributions mid-year.

Tip #7:

Tip #7 is to maximize Health Savings Account (HSA) contributions. HSAs are often referred to as “triple tax-advantaged” accounts because:

Contributions are pre-tax, reducing your taxable income.

Growth within the account is tax-free.

Withdrawals for qualified medical expenses are tax-free.

HSAs are particularly valuable for pre-retirees because they allow you to save for healthcare expenses in retirement. Unlike FSAs, HSA balances roll over each year and can be invested to grow over time. If you’re enrolled in a high-deductible health plan (HDHP), contribute the maximum amount to your HSA for 2024: $4,150 for individuals and $8,300 for families, with an additional $1,000 for those aged 55 or older. For example,

You’re 56 and enrolled in an HDHP, allowing you to contribute $9,300 ($8,300 family contribution limit + $1,000 catch-up). If you invest the maximum and the account grows at 6% annually, your HSA could grow significantly by retirement, providing tax-free funds for medical expenses.

If you’re not on track to hit the contribution limit, consider increasing your contributions before the year ends. You can also contribute for the 2024 tax year up until the tax filing deadline in April 2025.

As the year ends, it’s essential to take advantage of these seven year-end tax strategies to reduce your tax burden and position yourself for a more secure financial future. Whether it’s maximizing retirement account contributions, utilizing Roth conversions, or leveraging tax-advantaged accounts like FSAs and HSAs, each strategy provides a unique opportunity to save on taxes both now and in retirement.

Start implementing these strategies today, and enjoy the peace of mind that comes with knowing you’ve taken the necessary steps to secure your financial future.

Thanks for reading!