How to Pay 0% Capital Gains Tax

When you sell an investment for a profit, you are subject to taxes on the gains. It’s great that you were able to make money on the transaction, however, now you must cover the associated taxes. These taxes can be significant, especially if you find yourself in one of the higher tax brackets. Therefore, if you are interested in paying 0% capital gains tax, or at least reducing your end-of-year tax bill, then this is the blog for you.

Key Takeaways:

· Capital Gains Taxes Explained

· What is Your Taxable Income?

· Simple Deductions to Reduce Taxable Income

· Other Methods to Reduce Taxable Income

Capital Gains Taxes Explained

As covered above, capital gains tax applies when you sell an investment for more than you bought it. If the opposite were to happen and you sold the investment for less than you bought it, then that would be considered a capital loss, and no taxes would be required. Therefore, you will only incur capital gains when you sell an investment for a profit. The term investment here can refer to stocks, bonds, real estate, etc.

There are two types of capital gains and losses, short-term and long-term. Short-term capital gains/losses are incurred when an investment is held for less than one year. While long-term capital gains are incurred when an investment is held for over a year. Long-term capital gains receive preferential tax treatment, so typically, you would want to hold an investment for over a year before selling it.

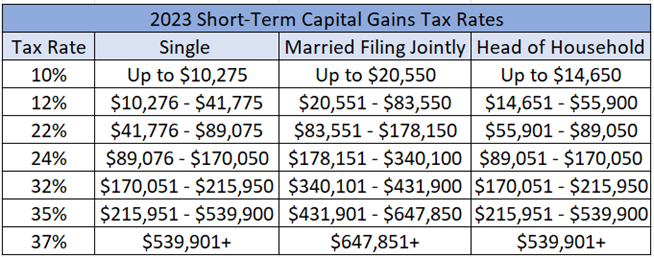

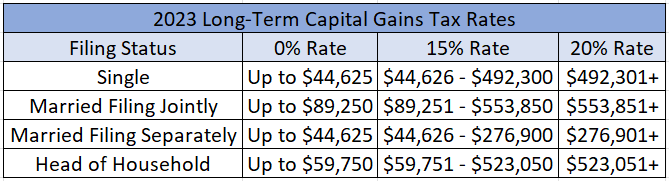

You can see this on the charts below. There is one for short-term capital gains and one for long-term. There are seven potential rates that you can pay on short-term gains which are dependent on your taxable income in the given year. If you are married filing jointly, then you are allowed to make more income than a single filer because the income is coming from and will be used for two people rather than one. Unfortunately, the rate for short-term gains can reach 37% for those who have a taxable income of over half a million dollars per year.

To contrast, long-term capital gains are divided into three potential tax rates. One of the potential rates is zero. This was not an option for short-term gains, but under long-term gains, certain individuals/couples do qualify for 0% tax on the profits from their investments held over one year. This was done to not only reward long-term investors, but to benefit those in retirement will low income while they withdraw funds from their retirement plans. Therefore, if you can get into the 0% long-term capital gains bracket then it would be in your best interest.

What is Your Taxable Income?

The key to unlocking lower capital gains tax rates is through your taxable income. To calculate your taxable income, you would take your total income subject to tax (gross income) and then subtract the applicable deductions and exemptions. It should not be too difficult to calculate as most people use the standard deduction. However, if you are unsure of your accuracy, then you can compare this year’s taxable income to last year. This could be found on Line 15 of your Form 1040. If you have not had any large changes to your income or expenses since last year, then your taxable income should be comparable.

Let’s quickly run through a taxable income calculation to ensure that you do this correctly. First, you must calculate your gross income. This includes $60,000 in wages, $2,500 in taxable interest and dividends, and $2,500 from a side-hustle for a total gross income of $65,000. Then we apply the deductions and exemptions. You can see which deductions and exemptions you qualified for in the previous year, but for this example, let’s imagine you have a $6,000 deduction from contributing to your Traditional IRA. On top of that, you can claim the standard deduction which is $13,850 for single filers. Therefore, this individual’s taxable income would be $45,150 in 2023.

This would result in said individual being in the 22% bracket for short-term capital gains and 15% for long-term capital gains. However, if the individual can reduce their taxable income by $525 then they could qualify for 0% long-term capital gains tax. That would make a 15% difference to profits on investments held one year or longer. So, how could we accomplish that?

Simple Deductions to Reduce Taxable Income

In this section, I will teach you several methods you can use to reduce your taxable income. Each of these methods is 100% legal and will not require you to take advantage of any grey areas. A few of these are simple deductions that you get for making contributions to certain accounts, while others are more technical and require a larger amount of knowledge to accomplish. Therefore, if you aren’t confident taking these actions, then it may be wise to reach out to a Financial Planner or Tax Accountant.

Let’s start with the easier strategies and work our way to the more complex. The first strategy is to contribute to a Traditional IRA or 401(k). This strategy benefits the user in two ways. First, they will receive a tax deduction for their contribution up to the maximum which is $6,500 in 20023 with a $1,000 catch-up clause for those age 50 or older. Then another benefit is that these accounts are tax deferred. Which means that short and long-term gains are not incurred when you sell an investment. Instead, taxes are paid when the funds are withdrawn from the account in the future. The same goes for a Health Savings Account (HSA), except the contribution for individuals is $3,850 and $7,750 for a family.

Another strategy would be to use a Roth IRA or Roth 401(k). These accounts take post-tax contributions, allow the investments to grow tax-deferred, and then withdrawn tax-free in the future. Therefore, the benefit does not come from the contribution itself like the example above. Instead, the Roth IRA or Roth 401(k) are used to draw tax-free income. For example, if a retired couple needed an additional $2,000 of income but could not incur any other taxes without passing the threshold, then they could take the $2,000 from a Roth Account as the funds are withdrawn tax-free.

Other easy strategies would include gifting assets to charity. You would receive a tax-deduction and no longer carry an asset with large capital gains. Another easy one is the primary residence exclusion. This allows individuals to exclude $250,0000 of capital gains from the sale of their primary residence. This exclusion increases to $500,000 for married couples so it can make a large difference on your total tax bill.

Other Strategies to Reduce Taxable Income

Another strategy commonly used by investors is known as matching losses. This allows the investor to offset their capital gains with past losses. Up to $3,000 of excess losses that are not used to cancel out gains can be used to offset ordinary income. However, the remainder of your losses can be carried forward into future years. Which means that if you have a large amount of capital gains one year, then you can start with cancelling them out using your past (and accumulated) capital losses.

Another strategy would be to hold your assets until you die. At that point, your beneficiaries would receive a stepped-up cost basis. Which means that the beneficiary would not take on your cost basis, but instead their cost basis would be the value of the asset on your date of death. This would allow your beneficiaries to avoid paying a lifetime of capital gains on said assets.

This final strategy involves more complex rules but should not be difficult for you if approached correctly. The 1031 Exchange is a way in which you can sell a rental or investment property without incurring capital gains. To do this, you would need to roll over the proceeds of the sale into a similar type of investment within 180 days (since the sale). Again, the rules are complex, but you can contact a 1031 specialist to assist you with the process.

Thank you for reading this blog. If you want help determining which strategies would be most suitable for you, then you should consider contacting a Financial Planner or Tax Accountant. Either of these professionals should be able to assist you. If you are interested, then you can follow the link to my calendar to book a consultation as I am a financial planner, myself. This would be a quick 20-minute phone call where we can discuss what you are looking for to understand if my expertise is a fit for your needs.